What Are the Most Common Myths About Fixing Credit?

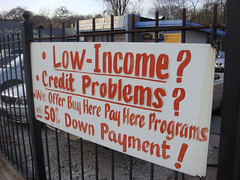

In today’s economy many of people are facing financial difficulties. Many of us lost jobs and live on savings and sometimes it is hard to make our ends meet. People late on payments, foreclose on houses and file for bankruptcy. This hurts credit history reports, leave negative marks on the credit history and lower credit score.

Today many people are looking for tips how to restore their credit report and what important is that they want to do it for free. Free credit repair is possible and not that hard, but there are many myths and misstatements about it.

Here are most common credit repair myths you’ll come across.

Credit repair is very hard task.

Fixing your credit is not that difficult and in fact, once you have the right information, it is very easy! By following easy steps you can improve credit report yourself.

Fixing credit is a quick process.

You can’t fix your credit overnight – but, you can improve it within a couple weeks. In many case people were able to improve their credit score within days.

Checking own credit history will hurt your score.

The truth of a matter is that checking your own credit report will NOT count against you at all! That’s why it is important to get your report before you start fixing your credit.

Credit reports are always accurate.

Almost half of all credit reports contain some un-true information! Mistake are very common and getting those mistake fixed or removed from your credit history will improve your score.

You need an attorney to fix credit report.

You don’t need to waste your money on a credit repair services or an attorney – you can do it yourself! Lawyers and credit repair companies charge huge fees for what can be done without their help. You just need right information and tools.

Some credit is so bad that it cannot be repaired.

Anyone can fix their credit score – regardless of what has happened in the past. It doesn’t matter how bad your credit history is because any credit can be improved.

Marriage and credit score.

Another popular myth about credit repair is that getting married can hurt your credit score if your new spouse has bad credit. In reality each person’s credit score is independent – even if they are married.

You can’t stop collection phone calls.

Debt collectors have laws governing them and you have rights as well. Using a simple letter can stop all harassing calls from collection agencies.

As you can see there are many credit repair myths that stop people from good credit score. Credit repair process is not hard and can be easily done by you. All you need is right tools and information. There are many credit repair sources online you can use to fix your report and there is no charge to use them. You can find great sources with credit repair information, sample dispute letters you can use to remove negative information from your credit. Hundreds of people have restored their credit without lawyers and credit repair companies, so can you!

Fast Credit Repair

To learn how to fix credit for free visit website http://www.credit-fix-secrets.com to learn what easy steps you need to make to fix your credit report.

Related Fixing Credit Articles

(out of 5 reviews)

(out of 5 reviews)