Repair Credit Report – Tired of Being Hindered by Bad Credibility? Repair Your Credit Report Here

How can a poor credit report push you to frustration? Well, when each and every financial solution will be closed. Due to your poor credit rating, it will be impossible to repair your report. The problem can be solved only when the problem is solved. Frustrating? Definitely. The vicious cycle can become very irritating.

You will be forced to settle for a less attractive job because your report did not support your claim of being disciplined and committed. You probably are postponing your girlfriend’s request to meet her parents primarily because you have a very poor report.

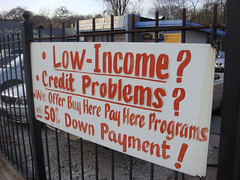

If you get scared every time your car breaks down, it is probably because you cannot afford even a used car loan. You will not be in a position to plan your finances because your poor credit report will ensure no lender even contemplates a transaction until you repair credit report.

In such a scenario, to even think or consider long term financial plans may seems like a joke. The first step that you should take is to find out ways and means to repair report as early as possible. Once you have the various options in your hand, you should proceed to check and identify the best possible one.

Once you have compared and analyzed the options and identified the best possible one around, you should deal with a professional and repair report effectively.

As a negative credit report leads to a vicious cycle that is very difficult to overcome, a positive credit report too will lead to benefits. A positive report will lead to a positive cycle. Any and every improvement in your report will lead to an improvement in your financial options.

You will find that lenders are prepared to negotiate. You will find that your interest rate comes down. You will discover that your down payment requirement is not very high. Considering all this, you can easily work towards the goal of improving your credit report even further.

As your score improves, you will find that it is easier to repair credit report. Considering all options, you should not postpone your visit to the professional by even a single day.

If they do not have time, make use of online resources board contact the professionals as early as possible. Have a free consultation session so that you will get an idea where you stand and how good the credit repair professional happens to be.

Many find themselves wanting credit report repair for a credit score of 700+, but don’t know what is necessary to achieve this goal. Disputing negative items on your credit report can be the first step to boosting your score. Negative items on a credit report must be validated, and those that aren’t must be removed. The end result is a credit report repair for the consumer. For more information on legal and efficient ways to repair credit, visit the following link:

Raise Credit Score

Rose Graham has been involved in the public sector, helping consumers rebuild their financial well being for the better portion of her working life.

Find More Repairing Credit Articles